Helpful pointers to help you navigate MTD

It’s become clear that HMRC is struggling with the rollout of Making Tax Digital (MTD) – both in terms of the technology infrastructure and their support resources. Here are a few helpful pointers to help you navigate MTD:

If you haven’t yet registered for MTD

In future, to submit your VAT returns via your accounting software you need to register with HMRC for Making Tax Digital. HMRC suggest that you register for MTD at least seven days before your next VAT return is due. If you pay your VAT bill by Direct Debit, you won’t be able to sign up in the seven days leading up to, or the five working days after the VAT return is due.

Steps to take:

You’ll need to have the VAT number of the business you’re signing up and your Government Gateway user ID and password handy.

- Log into your government gateway account

- You should see a screen with the ‘Sign Up to Making Tax Digital for VAT’ heading

- Click on the link to find out more about MTD for VAT (opens in a new tab)

- Click on the shortcut for ‘Sign up to Making Tax Digital for VAT’ – then scroll down to the sign-up link; select sign up your business from the link on the next page

Then, answer the following questions:

- Do you have accounting software for managing your VAT records? Yes

- Is your software ready to submit Making Tax Digital for VAT Returns directly to HMRC? Yes or No (Yes if you’re on Xero)

- Do you have more than one VAT registered business? Yes or No

- What type of business are you registered as? Pick relevant option

- What is your company number? This is your Companies House ID number

You should receive a confirmation email from HMRC within 72 hours of signing up. (If you need help registering with HMRC contact the VAT online services helpdesk who will be able to help).

If you use Xero, once you’re set-up with HMRC, you’re ready to complete your Making Tax Digital VAT return. (Xero has published some useful guidance on this process if needed).

Error message when trying to file your MTD VAT returns

From our experience, here are a few troubleshooting tips:

- Have you registered in the last couple of days? If so it can take HMRC up to 72 hours to move your info over to the new system. You might see the following message:

- Have you linked Xero to your HMRC account? If not you will get a message asking you to connect to HMRC, click on the blue button and follow the steps to connect Xero to HMRC using your government gateway details.

Your deadline for filing is approaching and you can’t get it filed

If the deadline for filing your VAT returns is approaching and you really can’t get your return filed, here are our suggestions on what to do:

-

- Open the VAT return in Xero and click “View” next to the following option

-

-

- Enter the date range for your current return

Check and review the figures. You will also need to calculate the liability from the box totals in the report (amount in box 1 less amount in box 4 – this is the figure you need to pay) - Make your payment to HMRC

- If you have a direct debit in place you will need to cancel this and setup again later when the issues with MTD are fixed

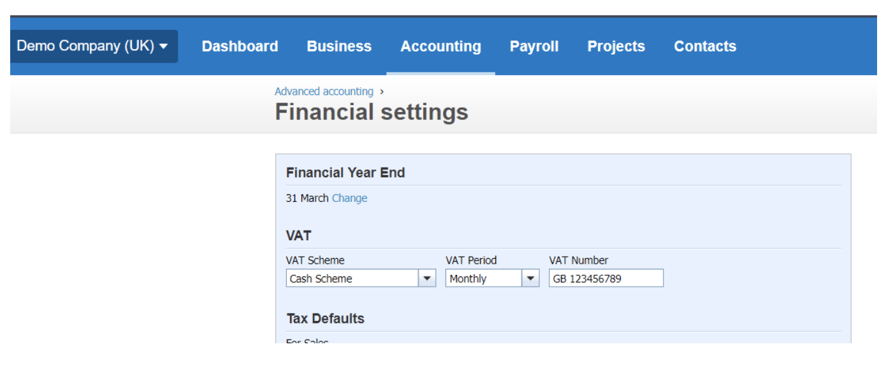

- Let HMRC know that you have made the payment but could not submit the return due to technical issues their end. The best way to contact HMRC is to give them a call on this number 0300 200 3700. You will need your VAT number when you speak to HMRC (this can be found in Xero – under Accounting, then Advanced, then Financial Settings)

- Enter the date range for your current return

-

-

-

- Lock Xero to the day of your last VAT quarter – this will ensure that the figures do not change

- File the return when the HMRC connection is working

-

Helpful links

We hope this helps. Most importantly, we want to reassure you that if you are struggling with MTD, you are not alone!