Top tips to help you understand inheritance tax in the UK

What is inheritance tax?

Inheritance tax (IHT) isn’t the easiest topic to bring up with loved ones, but it’s an incredibly important conversation to have. It’s essentially a tax on the estate of a deceased person and can affect most people at some point in their lives, one way or another.

Whilst IHT is necessary and inevitable, with careful planning there are ways to reduce your inheritance tax and safeguard your estate for the benefit of those around you.

In this blog, we'll explore IHT in more detail and discuss the most important rules you need to consider. We'll also look at your tax-free allowance, gift allowances and how to reduce your possible inheritance tax bill.

What is the current inheritance tax threshold in the UK?

The tax-free threshold or nil rate band (NRB) entitles each individual to £325,000 of their estate to be tax-free - this works similarly to the personal allowance for income tax.

For married couples and civil partners, the threshold can be transferred if one spouse passes away and does not use their total NRB, the remaining proportion can be transferred to the surviving spouse to be utilised against their estate.

What is the current inheritance tax rate in the UK?

As a standard rule, the current rate of IHT in the UK is 40%, and it applies to the value of the estate above the threshold of £325,000.

What assets are chargeable to IHT?

Your estate consists of all of your assets, including cash and property (stocks, real estate and any other investments).

When calculating your IHT liability, HMRC will also take into account any financial gifts you made in the 7 years before death and these will also form part of the IHT allowance for your estate.

Who pays inheritance tax?

IHT is paid by the executor of the deceased person's estate. In someone’s Will, they’ll have stated who this person is.

The executor is responsible for making sure that any IHT owed is paid to HM Revenue and Customs (HMRC) before distributing the deceased's estate to the beneficiaries.

Are there ways to reduce an inheritance tax bill?

There are tax-free allowances which we will discuss in the tips below which will help you to reduce your IHT.

By planning ahead, you can minimise the amount of IHT due and ensure as much of your estate as possible reaches your loved ones.

Inheritance Tax Planning

IHT planning involves taking steps to reduce your inheritance tax liability while you are still alive.

This can include making gifts, setting up trusts, or investing in assets that qualify for relief.

It's important to note that IHT planning can be complex, and it's essential to seek professional advice to ensure that you are using the most effective strategies for your situation.

Below we touch on some of the simplest ways to help reduce your IHT bill but we would always recommend you seek professional advice on how best to do this for your own personal financial situation.

Our top tips to help you reduce inheritance tax

1. Annual tax-free gift allowance

You have a £3,000 annual allowance that you can gift each tax year without it forming part of your estate and becoming liable to IHT.

This £3,000 is an allowance for you as an individual and not per recipient meaning if you have 2 children, it would be a gift of £1,500 each, rather than £3,000 each, to stay within the limits.

It’s worth noting that the annual allowance can be carried forward to the next tax year if unused, failing that, it will be lost.

2. 'Potentially exempt transfer' gift - PET

A "potentially exempt transfer" is a gift made between people while they are still alive, also known as a PET.

If you pass away within seven years of making the gift, the value of the gift can become part of your estate.

However, if you survive for 7 years after making the gift, no IHT will be charged and the value of the assets will be removed from the calculation of your estate.

Gifts to charity are exempt from inheritance tax.

3. Taper relief

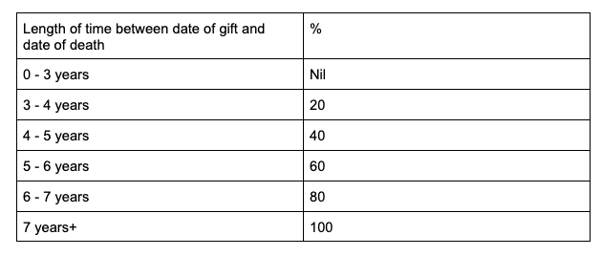

As above, if you make a gift (PET) and die within 7 years of making the gift, the value of this will be added to your estate and IHT may be due.

Taper relief reduces the tax due by a percentage, this percentage varies depending on the time between the date of gift and the date of death. Taper relief reduces the standard inheritance tax rate payable by the following:

4. Residence Nil Rate Band (RNRB)

The Residence Nil Rate Band (RNRB) is a specific allowance for the value of your home up to £175,000 per individual and is in addition to the regular NRB mentioned above.

Similarly to the NRB, the threshold can be transferred if one spouse passes away and does not use their total RNRB.

The RNRB will be deducted from the value of your home when calculating your estate provided your home is passed to a lineal descendant - this would be your child, grandchildren, great-grandchild etc.

For estates with a net value over £2 million, the RNRB is tapered by £1 for every £2 over that limit, meaning that no RNRB is available if an estate holds assets with a value in excess of £2.35M.

5. Reduced rate

The IHT rate will drop from 40% to 36% if you leave at least 10% of the value of your estate above the nil-rate band to charity.

This can often be instructed via a clause included in your Will.

6. Use of a Trust

Trusts can be used to hold assets for the benefit of your beneficiaries. Depending on the type of trust, assets held may not be subject to IHT.

This can be a complex area, and it's important to seek professional advice if you are considering using a trust to plan for IHT purposes.

7. Taking out a life insurance policy

A life insurance policy can provide a lump sum payment that can be used to pay any IHT owed.

This can be a useful strategy if you have a large estate and want to ensure that your loved ones are not burdened with a large tax bill.

Further questions about Inheritance Tax?

We hope you found this blog useful when considering some of the provisions available for inheritance planning. IHT is often overlooked and is one of the most punitive tax charges being levied at a staggering 40%.

By understanding the above and taking action, you can reduce your potential IHT liability and ensure that your loved ones are able to inherit more of your estate.

If you have any questions about Inheritance Tax or would like to review your potential exposure to IHT, if you're a client fill out form A and if you're not a client fill out form B - we’ll be in touch to discuss this further.

We try really hard to keep our blogs up to date, but sometimes the information and advice given are only correct at the time of writing. If you would like to discuss anything you read in our blogs please contact us.