Retaining talent – 3 things you need to know

We know that retaining talent is a challenge and with 65% of small businesses planning on recruiting this year, the war on talent will be hotter than ever before. With this in mind, we look at what the top-performing small businesses are doing to retain their best talent, what the hidden costs are of office perks, and how you can retain your key staff in 2017.

1) Office perks – What everyone else offers

In today’s hiring market, perks are essential for attracting and retaining top talent. According to Glassdoor’s Employment Confidence Survey, 80% of employees would choose additional benefits over a pay rise. Those considering whether to accept a job offer report that benefits and perks are a major factor.

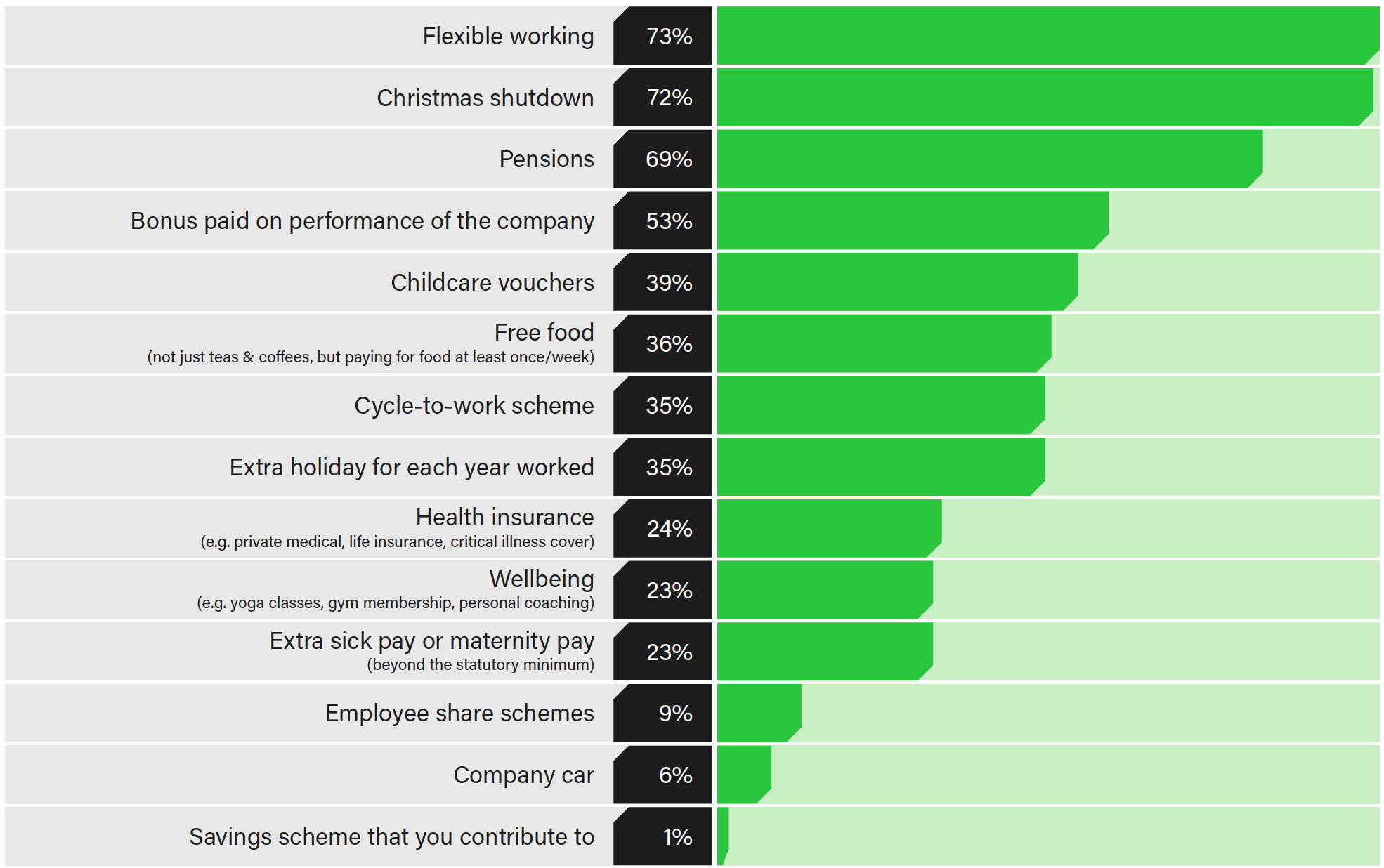

When we asked our clients what they offered their staff in terms of benefits, flexible working was the top answer. But with 73% of companies now offering flexible working as standard, can this really be considered a perk any more? To help stand out from the crowd, businesses are getting increasingly creative when it comes to staff benefits, with many offering entertainment setups in the office, free food, yoga, gym membership, plus Netflix and Spotify subscriptions. Check out what businesses currently offer their staff below:

2) Beware of hidden costs

Whilst the cost of a night out with the team is easy to see on the P&L, there are hidden tax costs associated with many traditional office perks offered by businesses. For example, did you know that if you offer any of your team regular benefits, e.g. private medical cover, gym membership or a company car, you’ll need to complete an annual form for each employee called a P11d, detailing the tax that they need to pay.

In addition, if your business has a beer fridge, regularly provides food for staff, or pays for trips to the pub, then HMRC require you to complete a PAYE Settlement Agreement to avoid your employees paying tax on these benefits. All of a sudden, those perks become more expensive than they looked on paper.

Practical tips

If you offer any of the above benefits to your staff, get in touch with us and we’ll let you know what your tax obligations are. You have until the end of the month to notify HMRC of any benefits offered in the tax year ending 5 April 2017, so please email tax@thewowcompany.com if you need help with this. All a HMRC inspector has to do is search for those Dominos Pizza receipts in your accounts and you could end up with an unexpected tax bill (and potential fine).

3) The most effective way to retain staff

So, are all these benefits actually worth it? When we asked business owners what the most effective way of retain staff was, the overwhelming response was ‘training and development.’

This anecdotal evidence is backed up by the numbers too, as retention rates were far better for those companies that invested in training and development. For example, 36% of staff said that the reason they left their company in 2016 was to join a larger business. This figure reduced to 9% in those companies that invested in training & development. This group were also more likely to achieve their growth targets (78% vs 54%).

With the average business in the UK expected to lose 17% of their staff in 2017, now is a great time to invest in the training & development of your team.

Practical tips

We’ve seen a number of clients move from annual appraisals to quarterly or even monthly reviews. Why wait until the end of the year to review progress with key staff members? Encourage each team member to produce their own personal development plan, and work with them regularly to show them a path from where they are to where they want to be (and how they can achieve their dreams within your business, rather than with someone else).

If you need any help with the tax calculations on the benefits that you offer your staff, email tax@thewowcompany.com or call 0345 201 1580. We’re here to help.