Help! What has changed with R&D claims?

The R&D world has seen quite a few changes over the past year and we are set to see a couple more come into play from 1 April 2024. It can be tricky to keep up with all the changes, so we have summarised the bits you need to know.

In a nutshell

- Companies under the SME scheme should be aware that their R&D spend may not reduce taxable profits as much as it once did.

- Larger companies should claim under the RDEC scheme, where you claim 20% on your R&D qualifying costs.

- All companies must submit an Additional Information Form (AIF).

- You can still claim for allowable costs, but there have been some changes.

- A new R&D scheme is being introduced for accounting periods starting from 01 April 2024.

If you're not sure what R&D is, read this to find out if you could be eligible and how we can help.

Changes in 2023

Rates

Back in April 2023, we saw the R&D scheme become a little less generous. To summarise:- The enhanced R&D expenditure deducted from your taxable profits decreased from 130% to 86%, which means your R&D spend may not reduce your taxable profits as much.

- The tax credit rate for loss-making companies decreased from 14.5% to 10%, so any cash credit back from HMRC may also be less than in previous years.

(You could still qualify for the 14.5% if you are an R&D-intensive company).

Any costs paid before 1 April 2023 will be subject to the older tax rates outlined above. For an in-depth analysis of the numbers, click here.

The summary above applies to companies applying under the SME scheme*. Larger companies should claim under a separate scheme known as the RDEC scheme. This is a tax credit-only scheme where you can claim 20% (or 13% prior to April 2023) on your R&D qualifying costs.

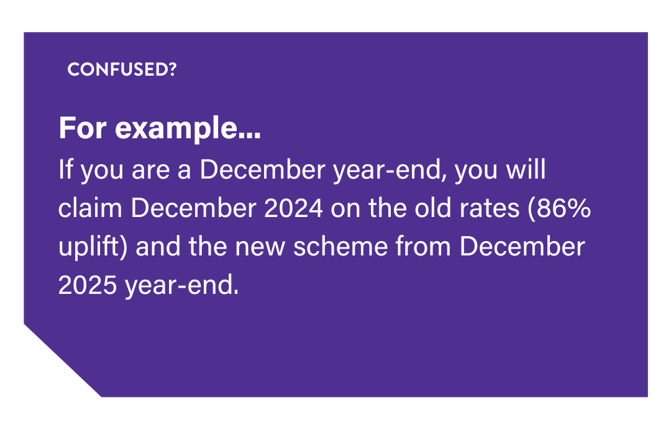

*Please note that these schemes are set to change again after 1 April 2024. More details about this can be found below.

You have up to two years after your financial year end to make an R&D claim

You may need to split the costs to make sure you are claiming the correct rate. Talk to us if you need some help with this.

Compliance

From 8 August 2023, it became mandatory for all companies making an R&D claim to submit an Additional Information Form (AIF) before submitting your application via your Corporation Tax return, this measure was introduced to help minimise the level of fraudulent claims being made. The form requires you to break down the R&D costs per project, and also supply some background information about the projects you are claiming for - therefore, you can no longer submit a claim without some form of narrative, however, we always recommend submitting an R&D report alongside your claims.

If your company hasn't made an R&D claim before, or hasn't for over three years, you may also need to notify HMRC separately in advance (and in addition to the AIF form above). This applies to accounting periods starting on or after 1 April 2023 and will need to be submitted within six months of your period end.

Allowable costs

You can still claim for salary, subcontractor, software and consumable costs, but there are some changes:

- Hosting & Cloud Computing Costs - allowed for accounting periods starting on or after 01 April 2023.

- Overseas Costs - Starting from accounting periods starting on or after 01 April 2024, no overseas costs will be allowed on R&D claims. This will form part of the new merged scheme (see below).

Changes in 2024

More changes! There's a new scheme

The SME and RDEC R&D schemes are merging into a single R&D tax credit. This means that a company that has an accounting period starting after 1 April 2024, can no longer claim under the current R&D schemes. Have a look at our breakdown of the Spring Budget here.

The merged scheme provides relief for profit-making companies of all sizes at the current rate of 20%. The tax credit is subject to Corporation Tax, which means the most profitable companies will receive a net benefit of 15% (where a company pays tax at the main rate of 25%).

The notional tax rate for loss-making companies of all sizes will be lowered to 19% in the merged scheme, resulting in a payable credit worth 16.2% of a company's R&D expenditure.

Here's an example: If the R&D costs are £50,000, the tax credit will be £50,000 x 20% x (1-19%) = £8,100.

If you need help with any of the above, please get in touch with our R&D specialist, Fantasia Scott.