Introduction of the Lifetime ISA (LISA)

If you’re saving for your first home or retirement, the Government’s newest savings scheme the Lifetime ISA (LISA) can add a 25% boost to your savings.

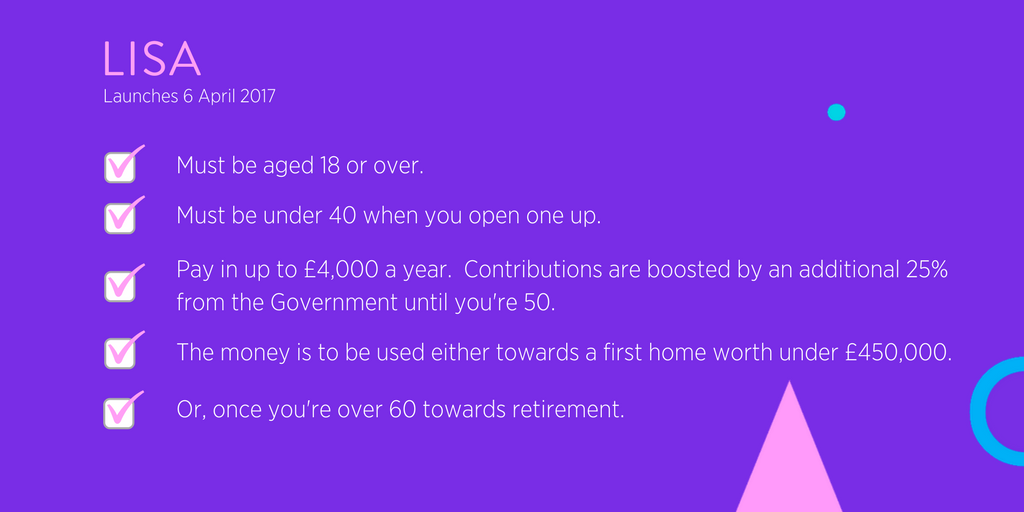

From 6 April 2017 any individual aged between 18 and 40 can open a LISA and pay in up to £4,000 a year. The additional 25% contribution from the Government will be made until you’re 50.

For 2017/18 the bonus will be paid once during the year. From April 2018 onwards it is proposed that the bonus will be paid monthly. Once in your account, it counts as your money. You’ll be paid interest on it too.

What can the money be used for?

Purchasing your first home with a LISA

The LISA is designed for two specific purposes. The first is for first-time buyers to use towards a residential property. That can be done at any time, provided the LISA’s been held for 12 months or more.

The home can be worth up to £450,000 and be anywhere across the country. As it is one account per person if a couple were buying a house jointly they could both benefit.

You can have a Help to Buy ISA and a LISA, but you can only use the bonus from one towards the house purchase. You can transfer your Help to Buy ISA into a LISA.

Using your LISA for retirement

The second is to take out and use in retirement once you hit age 60. With both, there is no tax to pay on it when you take the money out.

If you were to withdraw it before the age of 60 then the Government bonus and all interest on this is lost and you will suffer a 5% charge. So if you invested £4,000, this gets a 25% top up to make £5,000. If applied, the 25% penalty would slice £1,250 off, leaving £3,750 – or 6.5% less than your original investment.

Total limit for all ISAs is £20,000 for 2017/18 this includes any amount paid into a LISA. So if you save the maximum £4,000 a year into a LISA, you’ll still have a £16,000 allowance left to add to other ISAs.

To find out more please contact please call the office on 0345 201 1580 or email tax@thewowcompany.com. We’re here to help.